Quick Summary: What You’ll Learn About Lab Equipment Financing Without Credit

- Why business credit isn’t always necessary to finance lab equipment

- What alternative lenders like Bold View Capital look for instead

- A practical checklist for getting approved with no credit history

- How lab equipment financing can actually be a strategic advantage

Do You Really Need Credit to Finance Lab Equipment?

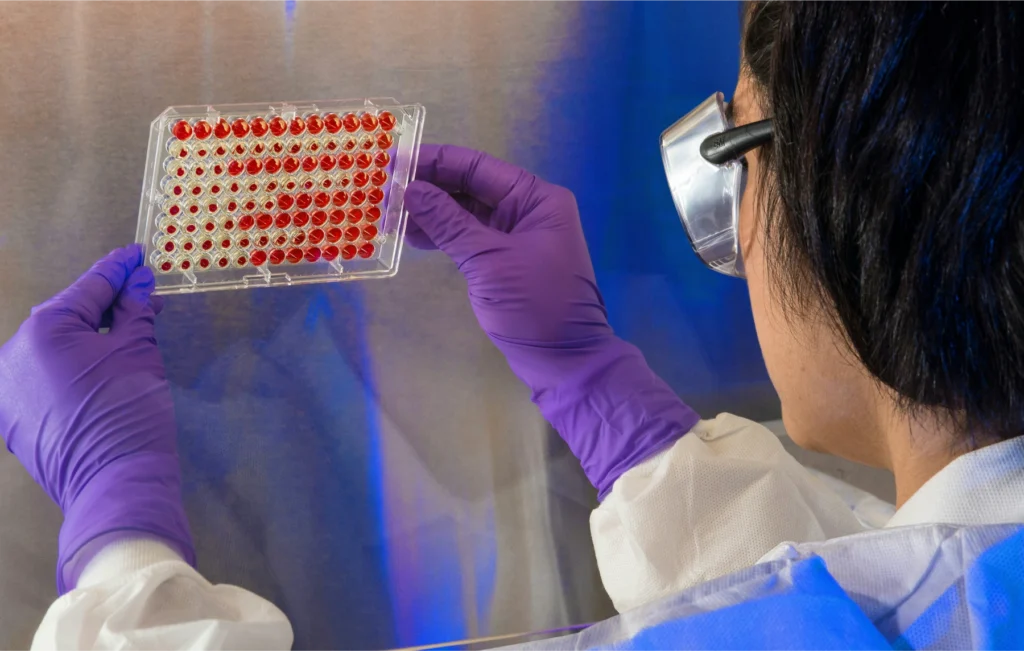

Ever feel like launching a lab without a credit history is a non-starter? You’re not alone. Many first-time lab founders, especially in biotech, environmental testing, or cannabis compliance, assume that without strong business credit, traditional financing just isn’t an option. Fortunately, there are solutions for lab equipment financing without credit.

Many entrepreneurs wonder about lab equipment financing without credit as an option for launching their businesses.

But here’s the good news: starting without a credit history doesn’t mean starting from zero.

With the right approach, a clear plan, and an understanding of how lenders evaluate early-stage businesses, it’s absolutely possible to secure lab equipment financing without a decades-long credit file.

Understanding different methods of lab equipment financing without credit can position you for success.

This guide breaks down what you actually need, what you don’t, and how to move forward with confidence.

How to Qualify for Lab Equipment Financing Without Credit

Experts agree that exploring lab equipment financing without credit can open doors for innovative startups.

Many traditional banks require years of credit history, revenue, and collateral. But alternative lenders – especially science-focused, self-funded firms like Bold View Capital – use a different playbook.

Here’s what really matters:

1. A Realistic Business Plan

Lenders don’t expect perfection, but they do look for thoughtfulness. Your plan should explain:

- What type of lab are you building? (e.g., diagnostics, cannabis testing, environmental compliance)

- Who are your customers, and what demand exists?

- What’s your pricing model and projected revenue?

- What equipment do you need, and how does it support your business?

Even a 2-page deck or memo can show strategy and feasibility.

2. A Legal Entity and Bank Account

This includes:

- A registered LLC, S-Corp, or corporation

- A business bank account

- An EIN from the IRS (optional but helpful)

Learn how to register your business with the SBA

3. A Financial Footprint

Even if you’re pre-revenue, show early-stage activity:

- Small capital raise (friends/family, seed)

- Grant award or LOI

- Lease or lab facility secured

- Personal investment into the business

4. Clarity on Equipment Use

Don’t just list gear. Connect it to your plan:

- “We need an LC/MS to meet pesticide testing compliance.”

- “This GC-FID setup enables quality control for our cannabis extractions.”

- “We’re scaling to support a 10-day turnaround contract, which requires a second HPLC.”

Justifying your request builds lender confidence.

What You Don’t Need to Launch Your Lab

Let’s bust a few common myths:

You don’t need business credit history. Early-stage labs rarely have one. What matters is your strategy and repayment plan.

For many, the pathway to success includes lab equipment financing without credit, highlighting the importance of strategy.

You don’t need perfect personal credit. It may be considered, but alternative lenders weigh it against your growth plan and financial picture.

You don’t need VC backing. Venture capital helps, but many founders lease equipment to preserve equity. Learn more about non-dilutive funding.

You don’t need to purchase everything up front. Flexible leasing and rentals let you start small, then scale as revenue grows. See why leasing analytical instruments makes sense.

Why Lab Financing Is Smart – Even If You Have Cash

Financing isn’t just a fallback. For startup labs, it can be the smartest financial strategy:

Finding the right approach for lab equipment financing without credit can be a game-changer for your lab.

- Preserve runway. Keep capital available for hiring, marketing, or regulatory costs.

- Stay flexible. Lease terms allow for upgrades, pivots, or early buyouts.

- Build credit through use. Financing helps establish your credit profile.

- Lower risk. Avoid betting your startup on a single upfront purchase.

What to Expect from a Financing Partner That Gets Startups

Look for these traits in your lender:

- Fast decision-making. Startup timelines matter.

- Simple documentation. You shouldn’t need five years of tax returns.

- Flexible terms. Ask about step-up payments, early buyouts, or deferred starts.

- Scientific fluency. Mass specs and GC systems aren’t like copiers.

- Clear communication. Know what’s required, what to expect, and when.

Checklist: How to Get Lab Equipment Financing Without Credit

- Register your business (LLC, S-Corp, etc.)

- Open a business bank account

- Draft a basic business plan or pitch deck

- Request equipment quotes from vendors

- Collect financial docs (e.g., LOI, proof of funds, contracts)

- Reach out to a direct financing partner

Final Thoughts: You Don’t Need History – You Need a Plan

Ultimately, lab equipment financing without credit allows you to focus on growth instead of past credit issues.

Every successful lab started with zero credit. If you have a clear strategy, a real business idea, and a need for equipment, you can get moving.

The right financing partner won’t just approve your deal. They’ll help you scale strategically, preserve equity, and stay capital-efficient.

Bold View Capital offers direct lab equipment financing for startups with no credit history. We move fast, ask smart questions, and help you get the tools to start testing.

We specialize in options for lab equipment financing without credit to help you start strong.