Are Credit History Challenges Hindering Your Lab’s Startup Dreams?

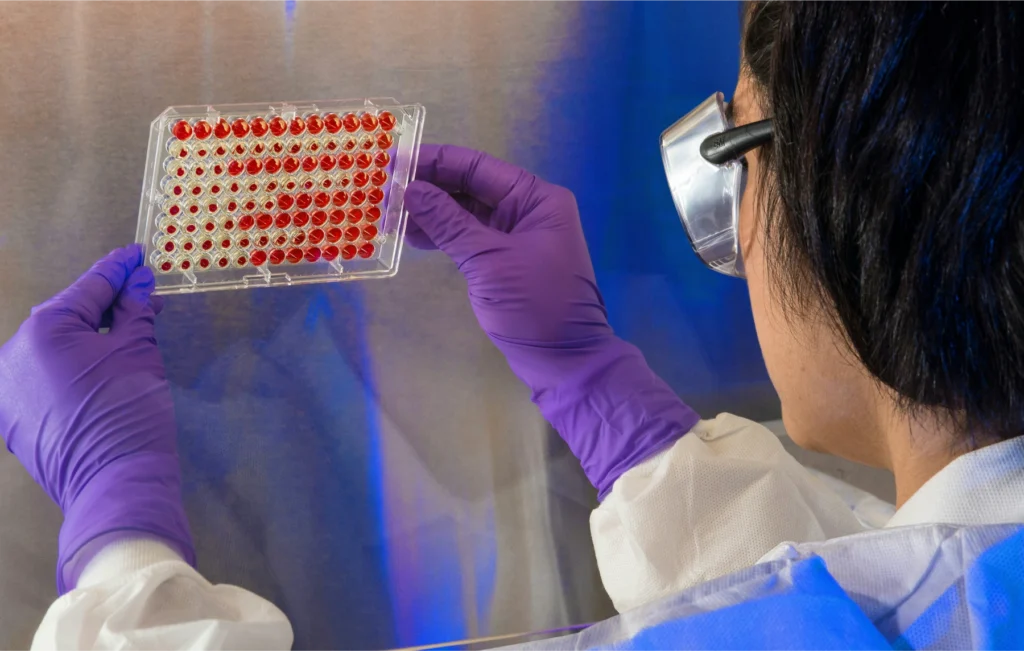

Starting a scientific testing laboratory is an exciting entrepreneurial journey, but one frequently complicated by financial hurdles. For entrepreneurs launching new labs, one common obstacle is a limited or nonexistent credit history, which often poses significant challenges when attempting to secure traditional financing for critical analytical instrumentation.

Yet, a credit history challenges don’t have to stall your plans. Innovative financing options exist specifically designed to support new testing laboratories across various scientific industries, enabling them to secure essential analytical instrumentation – even without an established credit profile.

This article explores how new lab owners can overcome credit history challenges by leveraging specialized financing programs, allowing their ventures to flourish without traditional credit restrictions.

Credit History Challenges Facing New Testing Labs

New testing labs across multiple scientific disciplines frequently encounter financial roadblocks due to their early-stage nature and specialized equipment needs:

- Limited Credit History: Most traditional banks and financing institutions require a proven credit track record, often impossible for new startups to provide.

- High Equipment Costs: Specialized analytical equipment such as chromatographs, mass spectrometers, microscopy systems, and laboratory software can be prohibitively expensive, complicating initial setup costs.

- Perceived Risk by Traditional Lenders: Early-stage laboratories are often seen as high-risk ventures by traditional financial institutions, which can limit access to necessary capital.

Given these complexities, startups must look beyond traditional financial institutions to sources better aligned with their specific needs.

Breaking the Credit Barrier: Financing Alternatives for New Labs

Innovative financing solutions tailored to new testing labs present viable alternatives to traditional bank loans, enabling startups to secure critical instrumentation without relying solely on credit history. Here are several benefits these solutions offer:

Flexible Qualification Requirements

Unlike traditional lenders, specialized financing providers often consider the overall viability of your business model, industry potential, and growth prospects rather than focusing narrowly on credit scores. Often, a robust business plan and active bank account can suffice.

Predictable and Manageable Costs

By spreading instrumentation costs into regular monthly payments, startups gain predictability in budgeting and cash flow management, helping maintain stable finances without large upfront investments.

Rapid Approval and Access to Equipment

Specialized financing partners typically streamline their approval processes, understanding that delays could significantly impact a startup’s momentum. Fast access to funds and equipment ensures you can commence operations promptly.

Scalable Solutions Aligned with Growth

Financing programs specifically designed for startups can scale in alignment with your growth trajectory. These flexible structures allow you to expand or upgrade instrumentation as your lab’s needs evolve, without significant additional hurdles.

Minimized Financial Risk

Avoiding large upfront expenditures significantly reduces financial risk. By financing your equipment, you preserve critical capital resources to respond effectively to unforeseen market or operational changes.

Essential Considerations When Selecting a Financing Partner

When exploring financing options, startups with credit history challenges should evaluate potential providers carefully.

Here are crucial considerations:

- Industry-Specific Experience: Providers familiar with analytical instrumentation and laboratory startup requirements can offer more tailored, practical solutions aligned with operational realities.

- Transparent Terms and Conditions: Choose financing partners offering clear, understandable agreements without hidden fees or complicated terms that could compromise your startup’s financial health.

- Customizable Financing Programs: Ideal financing solutions allow customization to fit your specific financial situation and growth trajectory, including options such as deferred payments or lease-to-own programs.

- Vendor and Supplier Relationships: Providers with established relationships within the analytical instrumentation industry can simplify procurement processes and potentially secure preferential pricing or faster delivery.

Realizing Your Vision: Overcoming Credit History Challenges

Lack of credit history should never impede entrepreneurial ambition, particularly in rapidly growing scientific sectors. Innovative financing solutions tailored to startups can break down credit barriers, facilitating immediate and strategic access to essential lab instrumentation.

By pursuing alternative financing options, entrepreneurs can quickly move beyond the constraints of traditional credit requirements and secure their lab’s future profitability and growth.

If you’re launching a new testing laboratory and concerned about your limited credit history, Bold View Capital specializes in providing tailored financing solutions specifically designed for startups with credit history challenges. With extensive experience supporting new labs across various scientific fields, Bold View Capital offers accessible, flexible programs based on your business plan and potential. Not solely your credit score.

Ready to overcome credit barriers and launch your laboratory successfully? Connect with Bold View Capital today.