Lab equipment is vital for research and development. But the cost of acquiring and maintaining such scientific equipment can be a financial strain for start-up companies.

To overcome this challenge, many start-ups are turning to a strategic financial solution known as lab equipment sale leasebacks. In this step-by-step guide, we will walk you through the process of sale leasebacks and highlight the benefits they offer to start-ups seeking to optimize their capital and operational strategies.

Step 1: Understand How Lab Equipment Sale Leaseback Works

A lab equipment sale leaseback involves selling your owned lab equipment to a leasing company and then leasing it back for a predetermined period. This process enables you to unlock the capital tied up in your equipment while still retaining access and usability.

It is a two-part transaction where you enter into an agreement to 1) sell the asset to a buyer and 2) lease the asset back from the buyer for a set period. Across all industries, a sale leaseback transaction has a shared definition. The first owner or “seller” of the asset becomes the lessee, and the financing company or “purchaser” becomes the lessor.

Step 2: Differentiate Between Lease and Sale Leaseback

While traditional equipment leases allow you to rent equipment without ownership, sale leasebacks involve leasing equipment you already own. The key distinction is that with a sale leaseback, you transfer ownership to the leasing company or investor, unlocking the value of the equipment and leasing it back for continued use.

Step 3: Identify the Benefits of Lab Equipment Sale Leasebacks

There are several benefits to sale leasebacks for life sciences companies. The few we’ll discuss here are raising capital, deploying capital to other business functions, operational continuity, and customizable lease terms.

Raising capital

A sale-leaseback enables you to get both the cash and the lab equipment you need to run your business. When a financing company buys one of your lab assets and then leases it back to you, this results in an immediate cash infusion and then at the end of the term, you own your equipment outright again.

Redeploy capital to other business functions

One of the primary advantages of a lab equipment sale leaseback is the ability to unlock capital. By selling the equipment and leasing it back, you gain immediate funds that can be reinvested in critical areas of your business, such as research, development, or expansion. This infusion of capital provides you with enhanced financial flexibility to pursue growth opportunities.

Operational continuity

Additionally, lab equipment sale leasebacks ensure operational continuity. You can continue using familiar equipment, avoiding the disruption and cost associated with replacing or upgrading lab equipment. This continuity allows you to maintain your research and development activities without interruption, supporting your scientific goals.

Customizable lease terms

In a sale leaseback, both parties work together to achieve fair and reasonable lease terms. Both the lessee and the lessor typically want the monthly lease rates to be at or below market. Plus, the length of the lease, renewal options and other terms can be customized to meet operating needs.

Step 4: Assess the Advantage of a Sale Leaseback to You as the Seller

As the seller, a sale leaseback allows you to optimize your assets. If you have underutilized lab equipment, selling it and leasing it back enables you to monetize these assets while still retaining access to the necessary equipment for your operations. This approach promotes asset efficiency and can lead to a more streamlined and cost-effective business model.

Step 5: Understand the Disadvantages and Risks

While sale leasebacks offer advantages, it is essential to consider the potential disadvantages and risks. The primary disadvantage is the loss of ownership. By transferring ownership to the leasing company or investor, you relinquish control over the equipment, which may limit your decision-making abilities regarding its use, modifications, or upgrades.

Step 6: Carefully Review the Terms and Conditions

Before entering into a sale leaseback agreement, thoroughly review the terms and conditions. Pay attention to any restrictions imposed by the leasing company, such as limitations on equipment usage or modifications. Ensure that these terms align with your operational needs and long-term growth plans.

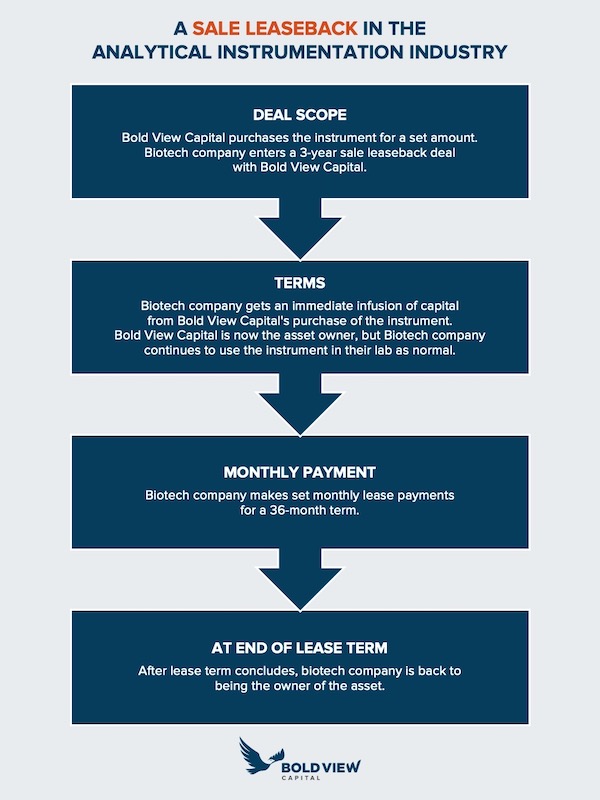

Let’s explore an example of a sale leaseback and what the workflow might look like:

A business owner needs capital to invest in a growth strategy. Cash is tight, and they recently bought a $200K analytical instrument.

Why does a sale leaseback work in this scenario?

Rather than diluting equity or taking out burdensome bank loans, this biotech company was able to use an asset they already owned as collateral for more capital. Plus, there is no disruption to normal lab operations because the asset stays put in the lab environment. The only thing that changes is asset ownership.

Final Thoughts on Lab Equipment Sale Leasebacks

Lab equipment sale leasebacks provide start-up companies with an opportunity to unlock capital, enhance financial flexibility, and ensure operational continuity. By converting owned equipment into immediate funds while retaining access to necessary lab equipment, you can optimize your capital allocation and focus on driving scientific advancements.

Sale leasebacks open an entire world of possibilities when it comes to alternative sources of capital. For companies in the life sciences and biotech spaces, where costly analytical instrumentation is status quo, being able to leverage an existing asset to get access to liquid cash can be an incredible asset – to your business goals and your balance sheet.

Evaluate your specific needs, financial capabilities, and long-term goals before engaging in a sale leaseback arrangement. With thorough consideration and strategic planning, lab equipment sale leasebacks can serve as a valuable financial tool for start-ups, maximizing value and flexibility in your research and development endeavors.

Lab equipment sale leasebacks are just one of many financing programs we offer. Learn about the other flexible financing and leasing programs we offer.