Still routinely sending your samples out to contract testing labs? Discover how financing programs have tipped the scales towards developing your in-house laboratory.

Introduction

For innovative industries like pharmaceutical, biotechnology and medical devices, testing at various stages of the development process is critical and frequent. And early on, life sciences companies decide whether this testing will be done in-house or whether research services are outsourced on a contract basis.

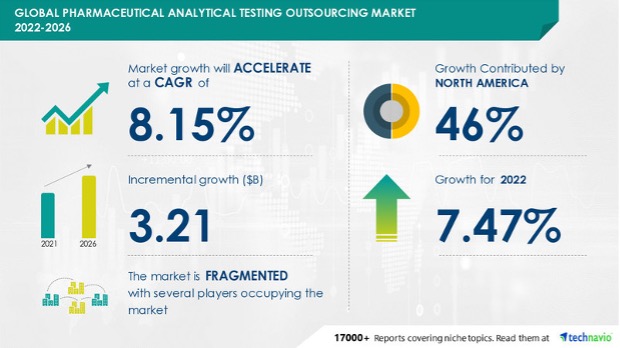

According to a recent market report by Technavio, the potential growth difference for the pharmaceutical analytical testing outsourcing market between 2021 and 2026 is USD 3.21 billion, with 46% of that growth contributed by North America.1 This growth can be attributed to the rising demand for analytical methods such as characterization, process monitoring, release testing, and stability assessment.

But first, let’s define – what is contract testing?

Contract testing is when companies farm out specific scientific research and testing on one or more components of projects to an external lab. These external labs are often referred to as contract testing labs.

Contracts can last just a few weeks for a single, specific task, or they can span many years for extended projects. In every case, the ownership of the project resides with the client, and the work of the contract lab typically represents just one portion of the overall project.

CROs (Contract Research Organizations) offer many services, including biopharmaceutical development, commercialization, clinical development, clinical trials management, and more.

What are reasons for outsourcing to a contract testing lab?

One of the biggest reasons you might outsource your testing to contract testing labs is to save money. This certainly pertains to smaller pharmaceutical or biotech companies that don’t have large laboratories yet.

These smaller organizations are enticed to save money by avoiding the investment in equipment and technical staff. Bigger, more established pharmaceutical companies have extensive in-house resources, so they tend to outsource for specific cost, speed, and/or quality considerations.

Another reason a company might work with contract testing labs is because they have a one-off or emerging need for highly specialized analytical tests, which require costly equipment. Examples include solid-state chemistry, specialized techniques that can include tools such as mass spectrometry, X-ray powder diffraction (XRPD), nuclear magnetic resonance (NMR), and near-infrared spectroscopy (NIR).

These techniques require operators that are experienced with using these instruments, and who can interpret data accurately. In addition, some of the equipment is expensive to use and maintain.

Another similar reason for outsourcing to a contract testing lab relates to method development. For early pharmaceutical discovery and development, the major effort is on the research and development phase this includes method development in the lab and the proper qualification and validation needed.

Challenges with contract testing labs

There are certainly some compelling reasons to outsource certain testing to a contract testing lab. But what are some of the challenges that can be faced?

- Long lead times – Long turnaround times for results can disrupt operations.

- Inefficiencies – Because you are working with a 3rd party, there is always a risk of low responsiveness, slipping deadlines, being subcontracted out, and more.

- Lower flexibility – In-house testing offers flexibility and control as well as the ability to address any questions or issues that may arise during the testing process.

How does financing address these problems?

We’ve outlined some of the pros and cons of working with a contract testing lab.

Now where does financing fit into this conversation?

Simply put, financing is a gateway to bring some of the previously outsourced testing in-house. If you can overcome the budget hurdles surrounding instrument acquisition, your company can afford to utilize the best, most-ideal instrumentation and equipment for your process.

The initial cost of the equipment is typically seen as the biggest obstacle. This can be overcome by opting to purchase an instrument through a financing or leasing program. Which means that instead of a large upfront cost, you can choose a financing program that fits your business needs.

Let’s look at a simple break-even calculation. Plugging in some numbers can help determine if in-house testing makes sense economically.

Assume a biotech startup has been outsourcing a particular set of tests to a contract testing lab. And the cost for this company to outsource each sample is $300/sample. Let’s also assume the cost of the lab equipment to perform that test is $300K. A quick leasing calculation says that the company could bring this particular analytical instrument in-house by financing the $300K piece of equipment for $9,600 per month over a 3-year period.

All things being equal, if the company outsources more than 32 samples per month it would make sense to bring testing in-house. And to go further, once the equipment is in-house, there is now an ability to analyze more samples (only the cost of consumables would factor in).

Of course, there might be some testing that still makes sense to outsource to a contract testing lab. And that’s the power of financing. It enables you and your team to decide on a strategy for what makes sense to bring in-house and outsource, and essentially eliminate the high upfront costs factor from your decision making.

Perhaps there is testing that needs to be done quicker or testing that you need to have more control over? Financing or leasing instrumentation that can perform these types of tests might make sense for your business.

As start-up companies grow, investing in more staff and specialized equipment is a necessity. Financing enables you to evolve your business operations without having to take a big hit to your capital spend. Some of the more routine testing or research that is more tightly ingrained in your process or is associated with intellectual property would be an ideal fit for bringing in-house through equipment financing.

Why should you consider bringing the testing in-house?

Markets like pharmaceuticals, biotechnology, and medical devices have a complex foundation of R&D. And in turn, these industries benefit from further development and honing of internal processes, which includes investing in analytical instrumentation.

Having your own suite of analytical instrumentation supports a move towards real-time. Instead of waiting for data to come back from a lab, you can get better insights into your products and processes through the power of real-time.

There are still scenarios where it makes economic sense to work with a contract testing lab. But at the end of the day, when testing is being performed using your own equipment, you are the priority.